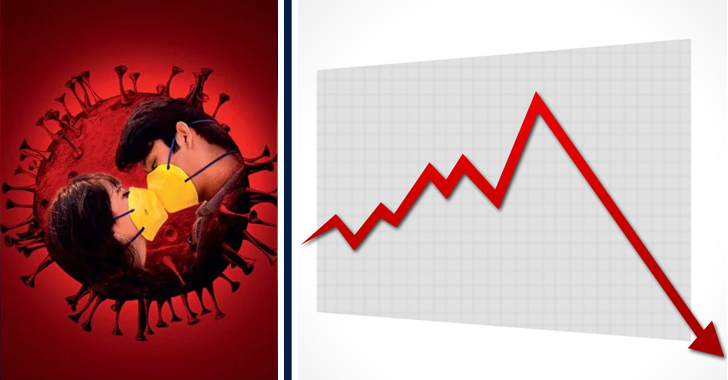

How corona is disrupting tech business?

Recently, in the rest of the world, the possibility of a slowdown in the economy is already assimilated, which turns into deep losses in stock market valuations. The driver or guideline of business was the advance of the coronavirus outside the borders of China, which ignited more than health alerts, due to its eventual impact on international trade and the expansion of central and emerging economies.

On Wall Street, a downward adjustment of more than 1,000 points or 3.6% was observed on Monday in the benchmark Dow Jones Industrials. With a loss of another 880 points (-3.1%) on Tuesday, the Dow Jones, at 27,081 points, returned to prices on November 1, two weeks after having posted all-time highs on February 12.

The Nasdaq is trading 8.2% below its all-time high since February 19. Tech stocks like Apple and Facebook have also fallen into correction territory, a drop of more than 10% from all-time highs that was reached last month.

On Tuesday, the Tokyo Nikkei Index extended the price range, with an average loss of 3.3%, while the European stock markets posted declines of around 2%, as in the FTSE of the London Stock Exchange.

New York stock markets traded a loss of 8.4% in the past two weeks, from 29,551 record points on February 12. For some analysts, it was a highly anticipated price adjustment after the longest bullish cycle in the history of the stock markets, which began on March 9, 2009, the floor of the “sub-prime” crisis.

In ten years and eleven months, the Dow Jones accumulated from that minimum record of 6,547 points a profit of 351% on average, an astronomical rate compared to the economic growth of the United States in little more than a decade. Jorge Fedio, the technical analyst at Clave Bursatil, defined the movement as “ world panic of the stock exchanges due to the dizzying rate of spread of the coronavirus. It was a crash of the collapse type.”

In this regard, Latin American currencies and exchanges experienced sharp falls. US Treasury Secretary Steven Mnuchin warned hours earlier that it is not appropriate to draw early conclusions about the disease’s impact on the global economy, or on supply chain decisions, assuring that it is still too early to find out.

Moreover, GDC (The Game Developers Conference) 2020 was one of the latest events which is “postponed”. Apart from all these things, the well-known online casino, of course, I am talking about the Leovegas casino, that you can use to play online casino. While now if we will talk about the Leovegas casino review, then let me clarify that it’s a very well-known platform, and doesn’t need to be justified. Moreover, the well-known event, the Mobile World Congress (MWC) 2020 was also canceled, simply avoid public gathering to stop the risk of transmission of Covid-19, as this event is represented by thousands of people from across the globe in one spot.

So, what do you think about this? Simply share all your views and thoughts in the comment section below. And if you liked this article then do not forget to share this article with your friends and family.